India’s animal healthcare landscape is experiencing unprecedented growth, with veterinary pharmaceutical companies playing a pivotal role in ensuring the health and wellbeing of millions of animals across the country. As the agricultural sector continues to modernize and pet ownership rises, understanding the best veterinary pharmaceutical companies in India–Inmed animal health becomes crucial for farmers, veterinarians, and animal health professionals.

Veterinary companies in india encompass a broad range of medicinal products specifically designed, formulated, and manufactured for animals. These products include:

• Vaccines – Preventive biologics against viral, bacterial, and parasitic diseases • Antibiotics – Therapeutic agents for treating bacterial infections • Anti-parasitic drugs – Medications for controlling internal and external parasites • Nutritional supplements – Products enhancing animal nutrition and growth • Hormones – Reproductive management and growth-promoting substances • Anesthetics – Pain management and surgical support medications • Feed additives – Growth promoters and health enhancers mixed with animal feed

Unlike human pharmaceuticals, veterinary medicines must account for diverse species physiology, varying body weights, different metabolic rates, and unique dosage requirements. The formulation process considers factors such as palatability for oral medications, delivery methods suitable for different animal sizes, and withdrawal periods for food-producing animals to ensure food safety.

India’s veterinary pharmaceutical sector holds immense significance for several compelling reasons:

• Supports livelihoods of approximately 70 million rural families who depend on livestock • Maintains health of 300 million cattle and buffalo, 230 million goats and sheep • Ensures consistent milk production contributing to India’s status as world’s largest milk producer • Prevents economic losses from disease outbreaks that could devastate farming operations

• Maintains consistent production of milk, eggs, and meat for domestic consumption • Ensures quality standards that meet export requirements • Prevents disease outbreaks that could disrupt food production systems • Supports India’s goal of achieving protein security for its growing population

• Prevents transmission of diseases from animals to humans • Controls conditions like rabies, avian influenza, and tuberculosis in animal populations • Reduces risk of pandemic scenarios originating from animal populations • Protects public health through comprehensive animal healthcare programs

The veterinary pharmaceutical market in India demonstrates remarkable growth potential:

| Market Metrics | 2024 | 2033 (Projected) | CAGR |

| Market Size | USD 1.73 billion | USD 4.17 billion | 10.23% |

| Export Value | USD 400 million | USD 1.2 billion | 12.5% |

| Domestic Consumption | 75% | 70% | – |

| Growth Rate Ranking | 3rd globally | 2nd globally | – |

| Animal Category | Market Share (%) | Growth Rate (%) | Key Products |

| Livestock | 65% | 9.5% | Vaccines, antibiotics, hormones |

| Poultry | 20% | 12.8% | Anticoccidials, growth promoters |

| Companion Animals | 10% | 18.2% | Flea/tick products, vaccines |

| Aquaculture | 5% | 15.6% | Water-soluble antibiotics, probiotics |

• Rising livestock population – Increasing by 2-3% annually • Government support – National Livestock Mission and subsidies • Pet ownership growth – 20% annual increase in urban areas • Food safety awareness – Consumer demand for quality animal products • Export opportunities – Growing international market access • Technology adoption – Precision farming and health monitoring systems

Veterinary pharmaceutical companies in India serve critical functions in modern animal healthcare:

• Disease prevention – Vaccination programs eliminate major livestock diseases • Herd immunity – Protecting entire populations from disease outbreaks • Cost effectiveness – Prevention costs significantly less than treatment • Production optimization – Healthy animals produce more milk, meat, and eggs

• Bacterial infection treatment – Antibiotics for pneumonia, mastitis, and other conditions • Parasitic disease control – Dewormers for internal and external parasites • Pain management – Anti-inflammatory drugs for injury and surgical recovery • Emergency treatment – Life-saving medications for critical conditions

• Growth promotion – Safe and effective growth enhancers for meat animals • Reproductive efficiency – Hormones for breeding programs and fertility improvement • Nutrition optimization – Supplements for better feed conversion and health • Stress reduction – Products managing transportation and environmental stress

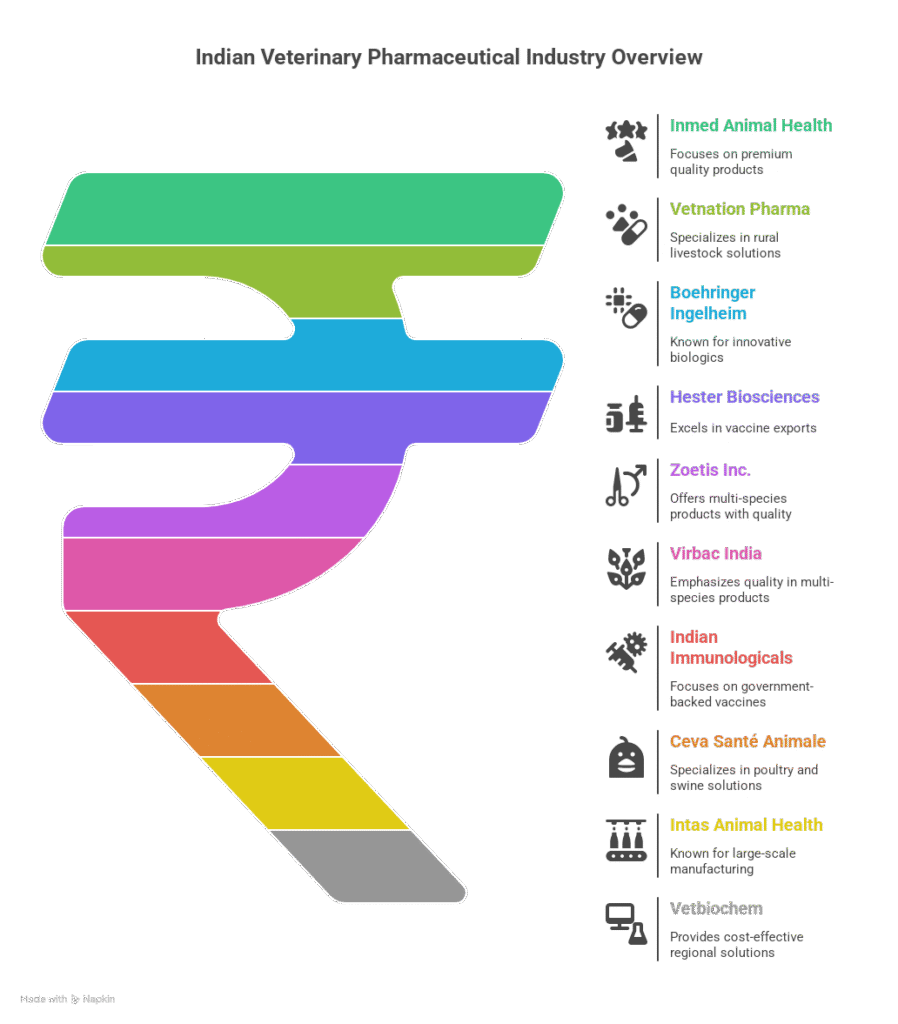

| Rank | Company | Market Focus | Strength |

| 1 | Inmed Animal Health | Premium segment | Quality focus |

| 2 | Vetnation Pharma | Livestock | Rural penetration |

| 3 | Boehringer Ingelberg | Biologics | Innovation |

| 4 | Hester Biosciences | Vaccines | Export expertise |

| 5 | Zoetis Inc. | Multi-species | Quality & Innovation |

| 6 | Virbac India | Multi-species | Quality focus |

| 7 | Indian Immunologicals | Government sector | Public backing |

| 8 | Ceva Santé Animale | Poultry/Swine | Technical expertise |

| 9 | Intas Animal Health | Diversified | Manufacturing scale |

| 10 | Vetbiochem | Regional markets | Cost effectiveness |

Market Position: Rising domestic player with innovation focus Advantages: • Strong commitment to research and development with modern facilities • Comprehensive product portfolio covering livestock, poultry, and companion animals • WHO-GMP certified manufacturing ensuring international quality standards • Competitive pricing strategy making products accessible to Indian farmers • Growing distribution network with focus on rural market penetration • Emphasis on sustainable and eco-friendly veterinary solutions • Strong technical support team providing field assistance to customers

Disadvantages: • Relatively newer brand compared to established multinational competitors • Limited international market presence requiring export development • Need for increased marketing investment to build brand awareness

Market Position: Leading domestic manufacturer Advantages: • Pioneer in Indian veterinary healthcare with 30+ years experience • WHO-GMP certified facilities ensuring international quality standards • Cost-effective pricing strategies suitable for Indian farmers • Extensive distribution network reaching remote rural areas • Strong focus on livestock productivity enhancement

Disadvantages: • Limited international presence compared to multinational competitors • Smaller R&D budget constraining innovation capabilities • Vulnerability to domestic market fluctuations

Market Position: Global leader in animal health Advantages: • World’s largest animal health company with extensive R&D capabilities • Comprehensive product portfolio covering all major species • Advanced manufacturing technologies meeting international standards • Strong regulatory compliance and quality assurance systems • Robust distribution network across urban and rural India

Disadvantages: • Premium pricing limits access in price-sensitive rural markets • Limited focus on India-specific diseases and conditions • Complex supply chain dependencies affecting product availability.

Market Position: Vaccine specialist with global reach Advantages: • Specialization in animal vaccine development and manufacturing • Strong export presence in 35+ countries globally • Government-approved vaccine supplier status in India • Advanced biotechnology capabilities and BSL-3 facilities • Cost-effective production methods enabling competitive pricing

Disadvantages: • Limited product diversification beyond vaccines • Dependency on government tenders for major revenue • Seasonal demand variations affecting cash flows

| Company | Vaccines | Antibiotics | Parasiticides | Feed Additives | Biologics |

| Inmed | ✓✓✓ | ✓✓✓ | ✓✓✓ | ✓✓ | ✓✓✓ |

| Vetnation | ✓✓✓ | ✓✓✓ | ✓✓ | ✓✓✓ | ✓✓ |

| Boehringer | ✓✓✓ | ✓✓ | ✓✓ | ✓ | ✓✓✓ |

| Hester | ✓✓✓ | ✓ | ✓ | ✓ | ✓✓✓ |

| Zoetis | ✓✓✓ | ✓✓✓ | ✓✓✓ | ✓✓ | ✓✓ |

| Virbac | ✓✓ | ✓✓✓ | ✓✓✓ | ✓✓ | ✓✓ |

Legend: ✓ = Limited range, ✓✓ = Moderate range, ✓✓✓ = Extensive range

Livestock Population Expansion • India maintains world’s largest cattle population (192.49 million) • Buffalo population growing at 1.06% annually • Small ruminant population expanding in rural areas • Intensive farming practices increasing veterinary medicine demand

Government Policy Support • National Livestock Mission – ₹2,800 crore allocation for livestock development • Rashtriya Gokul Mission – Indigenous breed improvement programs • Subsidies – 50-75% subsidy on veterinary medicines in rural areas • Import duty reduction – Lower duties on raw materials for domestic manufacturing

Rising Pet Ownership Trends • Urban pet population growing at 20% annually • Pet humanization driving premium product demand • Increasing veterinary clinic density in metropolitan areas • Growing awareness about preventive pet healthcare

Food Safety and Quality Awareness • Consumer demand for antibiotic-free meat and dairy products • Export market requirements for residue-free animal products • Organic farming movement creating demand for natural veterinary products • Traceability requirements driving systematic veterinary care adoption

| Factor | Impact Level | Market Growth (%) | Time Frame |

| Livestock Population Growth | High | 8-10% | 2024-2028 |

| Government Subsidies | Medium | 5-7% | Ongoing |

| Export Opportunities | High | 12-15% | 2024-2030 |

| Pet Market Expansion | Very High | 18-22% | 2024-2027 |

| Technology Adoption | Medium | 6-8% | 2025-2030 |

Veterinary pharmaceutical companies in India are embracing cutting-edge technologies to develop next-generation animal healthcare solutions:

• Long-acting injectables – Reducing dosing frequency from daily to monthly • Transdermal patches – Continuous medication delivery for companion animals • Oral formulations – Improved palatability using flavor-masking technologies • Targeted delivery – Nanoparticle-based systems for precise therapeutic action

• Recombinant vaccines – Safer and more effective than traditional killed vaccines • Monoclonal antibodies – Precision therapy for specific disease conditions • Probiotics and prebiotics – Gut health management and antibiotic alternatives • Gene therapy – Emerging treatments for genetic disorders in animals

Mobile Applications: • Vaccination scheduling and record keeping • Disease diagnosis support with image recognition • Veterinary consultation platforms • Farm management and health monitoring

IoT and Sensor Technology: • Real-time health monitoring devices for livestock • Environmental sensors for optimal housing conditions • Automated feeding and medication dispensing systems • Early disease detection through behavior pattern analysis

• Biodegradable packaging – Reducing environmental plastic waste • Green chemistry – Environmentally friendly manufacturing processes • Renewable energy – Solar and wind power in manufacturing facilities • Waste reduction – Circular economy principles in production

Dairy Cattle Solutions: • Mastitis treatment and prevention programs • Reproductive hormones for artificial insemination • Calcium supplements for preventing milk fever • Udder health maintenance products

Beef Cattle Management: • Growth promoters for improved feed conversion • Respiratory disease prevention vaccines • Parasite control programs • Stress reduction during transportation

| Product Category | Application | Market Share (%) | Growth Rate (%) |

| Anticoccidials | Broiler production | 35% | 12% |

| Vaccines | Disease prevention | 25% | 15% |

| Growth Promoters | Feed efficiency | 20% | 8% |

| Probiotics | Gut health | 15% | 22% |

| Antibiotics | Treatment | 5% | -3% |

Dog and Cat Products: • Flea and tick prevention treatments • Heartworm prevention medications • Dental care products and oral hygiene • Senior pet health management solutions • Behavioral modification medications

Exotic Pet Solutions: • Specialized nutrition for birds and reptiles • Antibiotic treatments safe for small animals • Surgical anesthetics for minor procedures • Emergency care medications for veterinary clinics

• Water-soluble antibiotics for fish diseases • Probiotics for maintaining pond water quality • Vaccines for major fish viral diseases • Oxygen enhancement products for intensive farming

The PCD (Propaganda cum Distribution) model has revolutionized how veterinary pharmaceutical companies in India reach rural markets and expand their distribution networks.

Territorial Exclusivity Benefits: • District-level monopoly rights preventing internal competition • State-level rights for high-potential markets • Product-specific monopoly for specialized medicines • Protected territories ensuring sustainable business development

Revenue Protection Measures: • Minimum order guarantees from franchisees • Price protection policies preventing undercutting • Market development support during initial phases • Performance-based territory expansion opportunities

Initial Setup Support: • Product inventory worth ₹2-5 lakhs on credit terms • Marketing materials and promotional literature • Territory mapping and market analysis • Customer database and contact information

Ongoing Business Support: • Monthly sales target achievement bonuses • Seasonal demand forecasting assistance • New product launch training and materials • Technical support for complex veterinary cases

| Training Component | Duration | Format | Frequency |

| Product Knowledge | 2-3 days | Classroom/Online | Quarterly |

| Sales Techniques | 1 day | Interactive workshop | Bi-annually |

| Technical Updates | 4 hours | Webinar | Monthly |

| Business Development | 2 days | Field training | Annually |

Investment Requirements: • Initial security deposit: ₹50,000 – ₹2,00,000 • Working capital: ₹1,00,000 – ₹5,00,000 • Vehicle and storage setup: ₹2,00,000 – ₹5,00,000

Profit Margins: • Prescription medicines: 15-20% • Over-the-counter products: 20-25% • Vaccines and biologics: 10-15% • Feed additives and supplements: 25-30%

Responsible Use Protocols: • Prescription-only medicine (POM-V) classification • Withdrawal period compliance for food animals • Antibiotic stewardship education for farmers • Development of antibiotic alternatives

Ethical Development Principles: • Minimizing animal testing through alternative methods • Ensuring products improve rather than mask welfare issues • Developing pain management solutions for surgical procedures • Supporting humane animal husbandry practices

Sustainable Manufacturing: • Wastewater treatment and recycling systems • Emission control technologies • Biodegradable packaging materials • Renewable energy adoption in manufacturing facilities

Key Responsibilities: • New drug approval and registration processes • Manufacturing license issuance and renewal • Good Manufacturing Practice (GMP) compliance monitoring • Import/export license management • Adverse event reporting and pharmacovigilance

Compliance Requirements: • WHO-GMP certification for manufacturing facilities • Product registration with safety and efficacy data • Regular facility inspections and audits • Batch release testing and documentation • Post-market surveillance and reporting

Regulatory Functions: • Distribution license management • Retail pharmacy inspections • Prescription monitoring systems • Local manufacturing oversight • Consumer complaint resolution

| Certification | Market Access | Investment Required | Time Frame |

| WHO-GMP | Domestic + Export | ₹5-10 crores | 12-18 months |

| EU-GMP | European markets | ₹10-20 crores | 18-24 months |

| USFDA | US markets | ₹15-30 crores | 24-36 months |

| Health Canada | Canadian markets | ₹8-15 crores | 18-30 months |

Pre-Independence Era (Before 1947) • Traditional herbal medicine dominance • Limited organized pharmaceutical activity • British colonial veterinary services • Import-dependent medicine supply

Foundation Phase (1947-1970) • Government veterinary college establishment • Indian Immunologicals Limited founding (1982) • Basic vaccine production capabilities • Rural veterinary service network development

Growth Phase (1970-1990) • Green Revolution increasing livestock productivity • Private sector entry into veterinary medicines • Technology transfer from international companies • Manufacturing infrastructure development

Liberalization Era (1990-2010) • Foreign investment liberalization • Quality system upgrades for export markets • Research and development investment increase • Professional veterinary education expansion

Modern Development (2010-Present) • Digital technology integration • Biotechnology product development • Sustainability focus in manufacturing • International market expansion

Advantages: • Highest milk production per capita in India • Advanced dairy farming infrastructure and cooperatives • Proximity to Delhi for regulatory and government access • Strong veterinary education institutions (LUVAS Hisar) • Well-developed cold chain for vaccine distribution

Disadvantages: • High industrial land costs (₹1-2 crores per acre) • Water scarcity affecting manufacturing operations • Seasonal demand fluctuations in agricultural areas • Increasing environmental compliance costs

Advantages: • Intensive agriculture with high veterinary medicine usage • Strong cooperative network (MILKFED, MARKFED) • High farmer income enabling premium product adoption • Excellent road and rail connectivity for distribution • Government support for animal husbandry development

Disadvantages: • Environmental concerns about chemical usage • Limited land availability for new manufacturing • Market saturation in certain product categories • Dependency on monsoon affecting seasonal sales

Advantages: • Largest livestock population (67.8 million cattle) • Extensive rural market with growth potential • Multiple veterinary colleges and research institutions • Government focus on livestock development programs • Strategic location for accessing multiple state markets

Disadvantages: • Complex bureaucratic processes slowing business operations • Infrastructure challenges in remote rural areas • Price sensitivity limiting premium product adoption • Fragmented market requiring extensive distribution networks

Advantages: • Bangalore biotechnology hub with skilled workforce • Government incentives for pharmaceutical manufacturing • Strong IT infrastructure supporting digital initiatives • Growing organic farming movement • Advanced research institutions (KVAFSU)

Disadvantages: • High competition for skilled professionals • Urban infrastructure strain affecting operations • Language barriers in rural market penetration • Increasing operational costs in metropolitan areas

Advantages: • Well-established pharmaceutical manufacturing ecosystem • Strong dairy cooperative movement (AAVIN network) • Excellent port facilities for export operations • Advanced veterinary education and research facilities • Supportive government policies for animal husbandry

Disadvantages: • Political uncertainties occasionally affecting business • High electricity costs impacting manufacturing economics • Cyclone risks requiring disaster preparedness investments • Competition for skilled technical workforce

| Parameter | North India | South India | Winner |

| Livestock Population | Higher | Moderate | North |

| Technology Adoption | Moderate | Higher | South |

| Regulatory Environment | Complex | Streamlined | South |

| Manufacturing Costs | Higher | Lower | South |

| Market Access | Better | Moderate | North |

| Export Infrastructure | Limited | Excellent | South |

Veterinary pharmaceutical companies in India specialize in medicines designed specifically for animals, requiring unique expertise in: • Multi-species physiology and metabolism understanding • Food safety residue management for livestock products • Species-specific dosage calculations and formulations • Palatability considerations for different animal preferences • Withdrawal period compliance for food-producing animals • Environmental impact assessment of animal medication residues

Key Quality Indicators: • WHO-GMP certification and facility compliance • Product registration status with CDSCO • Clinical trial data and efficacy studies • Batch testing reports and quality certificates • Pharmacovigilance systems for safety monitoring • International market approvals and exports

Investment Breakdown: • Security deposit: ₹50,000 – ₹2,00,000 • Initial inventory: ₹1,00,000 – ₹5,00,000 • Working capital: ₹2,00,000 – ₹5,00,000 • Infrastructure setup: ₹1,00,000 – ₹3,00,000 • Total investment range: ₹4,50,000 – ₹15,00,000

Responsible Use Measures: • Prescription-only medicine (POM-V) classification implementation • Veterinarian education about appropriate antibiotic selection • Withdrawal period guidelines for food-producing animals • Alternative therapy development (probiotics, herbal medicines) • Residue monitoring programs in collaboration with food safety authorities

Market Growth Projections: • Current market size: ₹1,200 crores (2024) • Projected market size: ₹3,500 crores (2030) • Annual growth rate: 18-22% • Key growth drivers: Urban pet ownership, pet humanization, veterinary clinic expansion • Major product categories: Vaccines, flea/tick treatments, dental care, senior pet care

Recent Regulatory Impacts: • New Drug and Clinical Trial Rules 2019 streamlining approval processes • Pharmacovigilance Programme for Animal Drugs implementation • E-commerce regulations affecting online veterinary medicine sales • Environmental clearance requirements for manufacturing facilities • Import registration procedures for raw materials and finished products

Technology Applications: • Artificial intelligence for drug discovery and development • IoT sensors for real-time animal health monitoring • Mobile applications for veterinary consultation and record keeping • Blockchain technology for supply chain traceability • Nanotechnology for targeted drug delivery systems • Telemedicine platforms connecting rural farmers with veterinary experts

Access Channels: • Regional distributor networks covering rural areas • Direct company representatives for technical support • Online ordering platforms with home delivery • Veterinary association partnerships and bulk purchasing • Credit facilities and payment term flexibility • Training programs for product knowledge and usage

Export Market Analysis: • Current export value: ₹2,800 crores (2024) • Target markets: Southeast Asia, Africa, Latin America, Middle East • Growth rate: 12-15% annually • Key export products: Vaccines, feed additives, generic medicines • Regulatory requirements: WHO-GMP, destination country registrations • Government support: Export promotion schemes and incentives

Sustainability Contributions: • Developing eco-friendly packaging materials and biodegradable formulations • Reducing antibiotic usage through alternative therapy development • Supporting organic farming with approved natural veterinary products • Implementing green manufacturing processes and renewable energy usage • Promoting precision livestock farming through technology integration • Collaborating with farmers on sustainable animal husbandry practices

The veterinary pharmaceutical industry in India represents a dynamic and rapidly evolving sector with tremendous growth potential. Veterinary pharmaceutical companies in India are well-positioned to capitalize on increasing livestock populations, growing pet ownership, government support initiatives, and expanding export opportunities.

Success in this industry requires understanding complex regulatory environments, maintaining high quality standards, developing innovative products, and building strong distribution networks that reach both urban and rural markets.

As the industry continues to evolve with technological advancements and changing market demands, companies that invest in research and development, maintain ethical practices, and focus on sustainable growth will emerge as leaders in India’s thriving veterinary pharmaceutical landscape.

Whether you’re considering entering this market as an entrepreneur, investor, or industry professional, the opportunities are substantial for those who understand the unique challenges and requirements of animal healthcare in India’s diverse and dynamic market environment.